No. 040 – How to get the best pension from your hard-earned retirement savings

Question

I retired three years ago, with half my income coming from my company pension fund and the other half from interest from investments. I am paying tax at a rate of 41%. Is there anything that I can do to reduce this amount?

Answer

Your pension will depend on the type of structure you choose. You have a number of options with various pros and cons. I will go through three that could work for you:

Living annuity

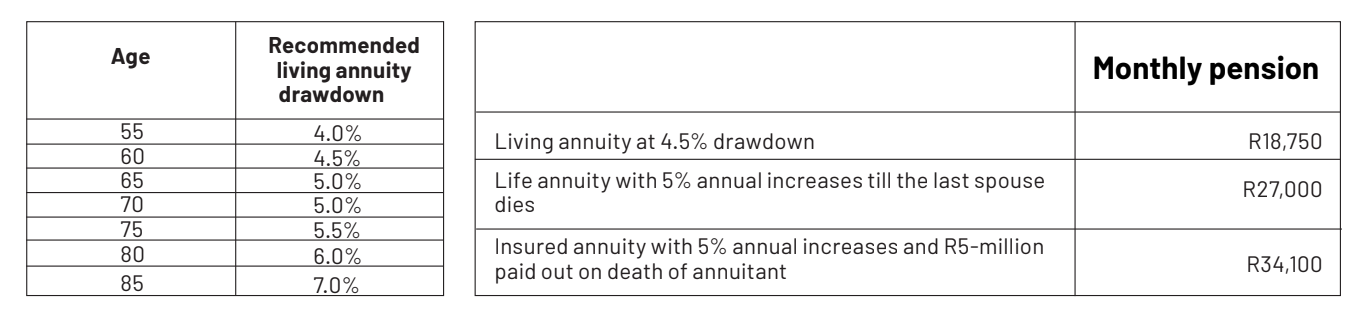

With a living annuity, your R5-million will be invested and you will receive a monthly drawdown from this investment.As long as your drawdown does not exceed the growth and costs of the investment, you will be fine. If you draw down too much, you run the risk of using up your capital and not having anything to live on in later years.There are guidelines as to how much you should draw at particular ages.A 60-year-old may comfortably draw 4.5% a year and a 65-year-old may draw 5% a year.Your wife being 60, you would need to use the 4.5% drawdown because you need the pension to last for both of your lives.A drawdown of 4.5% would give you a monthly pension of R18,750 from a living annuity of R5-million.

A life annuity will typically give you a bigger monthly pension than a living annuity.A challenge that you have, however, is that the annuity must be payable for both your and your wife’s lives. Life annuities are lower for women because they live longer than men, so the pension will be paid for longer. Your situation is compounded by your wife being five years younger than you.That being said, a R5-million life annuity that increases by 5% a year and is payable in full until both you and your wife die will give you R27,000 a month.If you elect to have the pension change to 75% of its value when the first spouse dies, you will get R28,800 a month.

Insured life annuity

A clever way of getting around the issue of joint life annuity being affected by the rates applied to a younger spouse is to go the route of an insured annuity.What happens here is that you buy a single life annuity with a proviso that the capital be paid out when you die. Your spouse would then use the payout to purchase an annuity for themselves. Hopefully this will be in many years’ time.As you get older, the size of the annuity your spouse can get will increase because it will be paid for a shorter period.You need to weigh this against the impact of inflation on your capital amount. In many instances, this can be a viable alternative to going the route of a joint life annuity.If you purchased one of these, your investment of R5-million would give you a monthly pension of R34,100 a month, increasing by 5% a year. When you die, R5-million would be paid to your spouse. She could then use this to purchase an annuity for herself.This type of annuity is also suitable for those who would like to leave their children some money and do not want to deal with the investment and longevity risks that they carry with a living annuity.Remember, with a living annuity you carry the risk of the markets not performing or of you outliving your money.On the other hand, when you pass away, the value of the living annuity may be bequeathed to your heirs.As you can see, the pension you can receive differs widely. There are also hybrid solutions in between these options. Each of these has different implications in terms of tax and capital payouts. It is important to speak to someone who can help you choose the optimal solution.

KENNY MEIRING IS AN INDEPENDENT FINANCIAL ADVISER

Contact him via phone, email or via contact phone on the financialwellnesscoach.co.za website

Read more of our articles on the Daily Maverick website or newspaper weekly!