158 - Getting more bank for your buck with your retirement monies

Question:

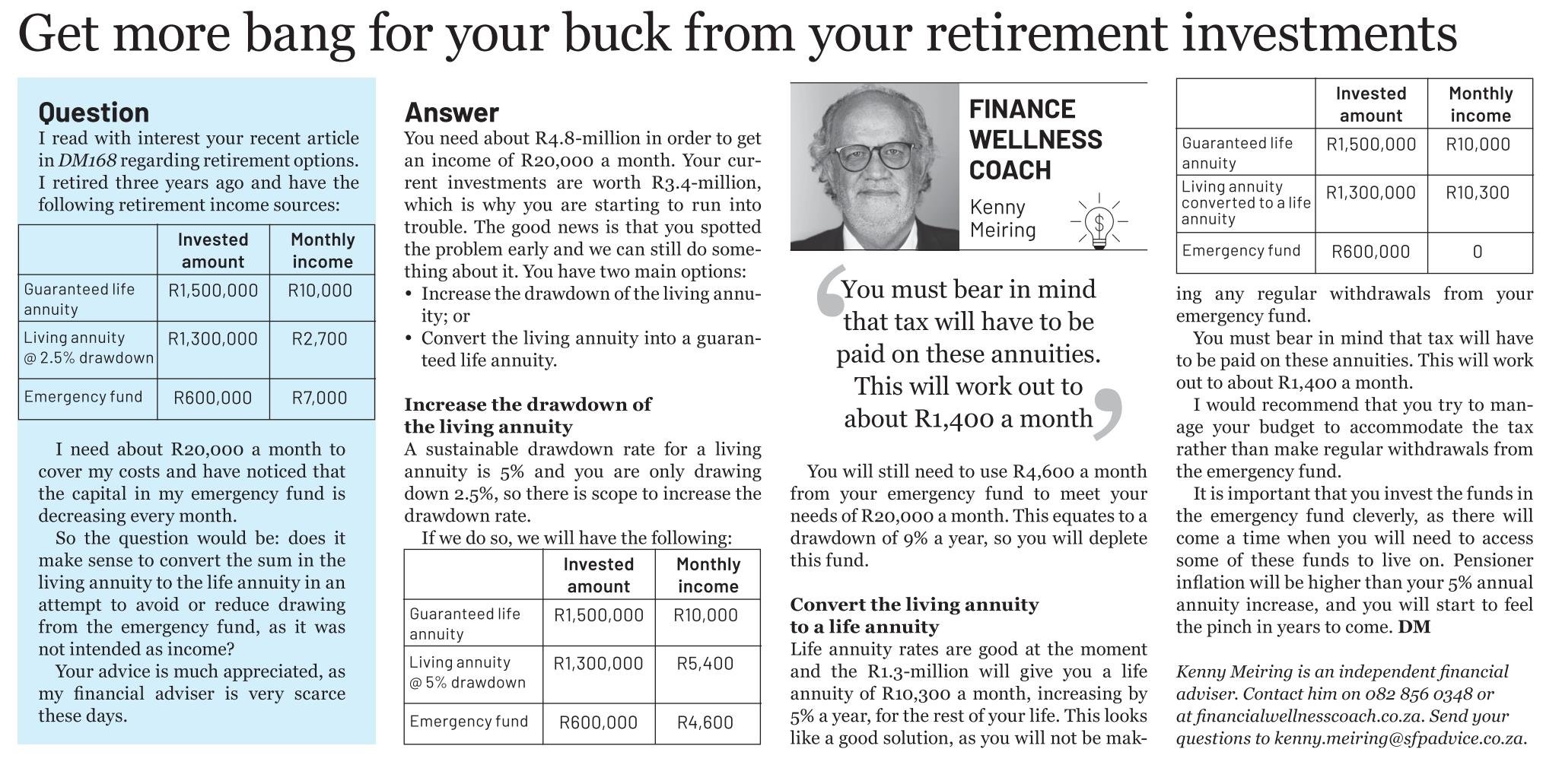

I read with interest your recent article in the DM regarding retirement options. I retired 3 years ago and have the following retirement income sources:

| Invested Amount | Monthly income | |

| Guaranteed Life annuity | R1 500 000 | R10 000 |

| Living Annuity @2.5% drawdown | R1 300 000 | R2 700 |

| Emergency fund | R600 000 | R7 000 |

I need about R20,000 a month to cover my costs and have noticed that the capital in my emergency fund is decreasing every month.

So the question would be, does it make sense to convert the sum in the living annuity to the life annuity in an attempt to avoid or reduce the draw from the emergency fund, as it was not intended as income.

Your advice is much appreciated as my Financial Advisor is very scarce these days!

Answer:

You need around R4.8m in order to get an income of R20 000 a month. Your current investments are worth R3.4m which is why you are starting to run into trouble. The good news is that you spotted the problem early and we can still do something about it. You have two main options open to you:

- Increase the drawdown of the living annuity

- Convert the living annuity into a guaranteed life annuity

Increasing the drawdown of the living annuity

A sustainable drawdown rate for a living annuity is 5% and you are only drawing down 2.5% so there is scope to increase the drawdown rate.

If we do so, we will have the following:

| Invested Amount | Monthly income | |

| Guaranteed Life annuity | R1 500 000 | R10 000 |

| Living Annuity 5% drawdown | R1 300 000 | R5 400 |

| Emergency fund | R600 000 | R4 600 |

You will still need to use R4 600 a month from your emergency fund to meet your R20 000 a month needs. This equates to a 9% drawdown a year so you will deplete this fund over the next couple of years.

Convert the living annuity to a life annuity

Life annuity rates are currently good and the R1.3m that you have in a living annuity will give you a life annuity of R10 300 a month, increasing by 5% a year for the rest of your life.

| Invested Amount | Monthly income | |

| Guaranteed Life annuity | R1 500 000 | R10 000 |

| Living Annuity converted to a Life Annuity | R1 300 000 | R10 300 |

| Emergency fund | R600 000 | 0 |

This looks like a good solution as you will not be making any regular withdrawals from your emergency fund.

You must bear in mind that tax will have to be paid on these annuities. This will work out to around R1 400 a month. I would recommend that you try to manage your budget to accommodate the tax rather than make regular withdrawals from the emergency fund.

It is important that you invest the funds in the emergency fund cleverly as there will come a time when you will need to access some of these funds to live on. Pensioner inflation will be higher than your 5% annual annuity increase, and you will start to feel the pinch in years to come.

Kenny Meiring MBA CFP ® is an independent financial adviser who helps people put investment and risk structures in place to live wonderful lives. You can contact him on 082 856 0348 or at Financialwellnesscoach.co.za. Please send your questions to kenny.meiring@sfpwealth.co.za