155 - Making your retirement investments work for you

Question:

My wife and I have been on retirement for the past 10 years. What was a very decent pension when we retired, is not that great anymore and we are finding it increasingly difficult to make ends meet. We are currently drawing down 6% from our living annuity. I'm scared to increase this amount as we could use up our capital and run out of money.

Is there anything that we can do to improve the situation?

Answer:

Your problem is not unique. There are many retired people who experience this after being on pension for more than five years.

There are two main reasons for this:

- inflation for pensioners is a lot higher than the normal inflation. A significant part of a retired person's budget goes towards medical aid and electricity. Both of these items have increased massively over the past couple of years.

- Retired people often invest their funds in very conservative portfolios as they do not want to lose money. Over time, the impact of the 2% or 3% additional growth each year which they have given up by being in a portfolio that is too conservative is felt with the size of your capital not being high enough to meet the higher income needs.

As we are living a lot longer than our parents did, we need to plan on living to 100. If you retire at 65, you would have a retirement timeframe of 35 years. To put that in perspective, that is the same time frame that it took you to get from age 30 to 65. If you think about all the changes that you had in your life over that period and the changes in salary that you experienced, you can appreciate why it is important to invest your retirement funds correctly.

Solutions

There are two possible solutions that I would consider.

- Restructure your investments

You should get a skilled financial advisor to calculate what return you need on your investments to meet your after-tax income needs. This would typically be a return of between inflation + 2% and inflation + 5%.

Once you have this number, you can structure your retirement investment portfolio to ensure that you have a stable income over the short and medium term and enough growth over the long term to meet your overall target.

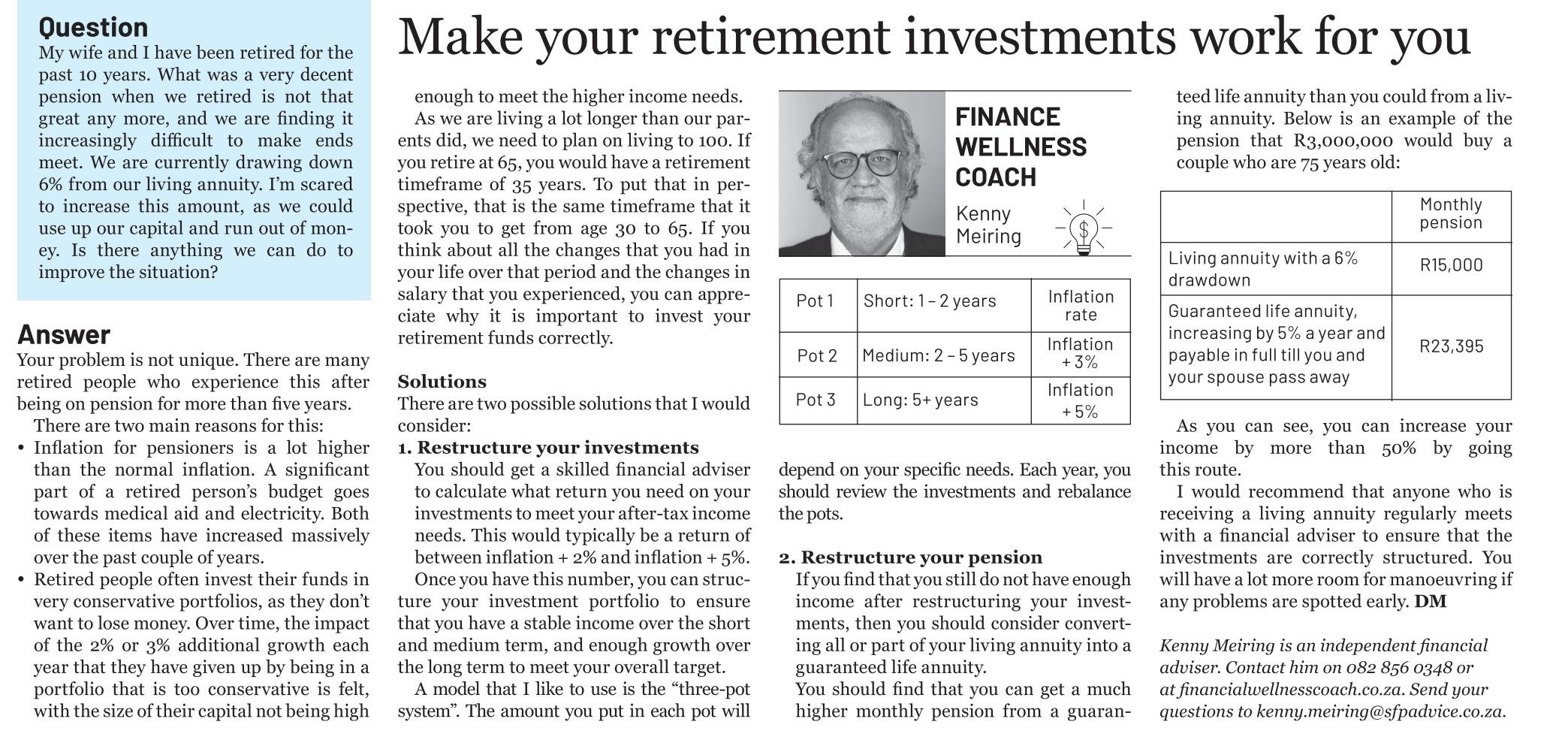

A model that I like to use is the “3 pot system”

| Pot 1 | Short (1 – 2 years) | Inflation rate |

| Pot 2 | Medium (2 – 5 years) | Inflation + 3% |

| Pot 3 | Long 5+ years | Inflation + 5% |

The amount you put in each pot will depend on your specific needs. Each year, you should review the investments and rebalance the pots.

- Restructure your pension

If you find that you still do not have enough income after restructuring your investments, then you should consider converting all or part of your living annuity into a guaranteed life annuity.

You should find that you can get a much higher monthly pension from a guaranteed life annuity than you could from a living annuity. Below is an example of the pension that R3 000 000 would buy a couple who are 75 years old:

| Monthly pension | |

| Living annuity with a 6% drawdown | R15,000 |

| Guaranteed life annuity, increasing by 5% a year and payable in full till you and your spouse pass away | R23,395 |

As you can see, you can increase your income by over 50% by going this route.

I would recommend that anyone who is receiving a living annuity, regularly meets with a financial adviser to ensure that the investments are correctly structured. You will have a lot more room for manoeuvre if any problems are spotted early.

Kenny Meiring MBA CFP ® is an independent financial adviser who helps people put investment and risk structures in place to live wonderful lives. You can contact him on 082 856 0348 or at Financialwellnesscoach.co.za. Please send your questions to kenny.meiring@sfpwealth.co.za